Markets now think the European Central Bank will have to raise interest rates to a record high 4% if it is to make headway in crushing inflation that has been running at more than four times its 2% target.

It’s a treacherous trajectory along which other important central banks like the Federal Reserve are also travelling, as they strive to combat the most intense price pressures in decades by slowing but not crashing their economies.

The difficulty of the task the ECB faces may become clearer on Thursday, when at 11 a.m. CET (5 a.m. Eastern) the first reading, or “flash’” of the eurozone consumer prices report for February will be released.

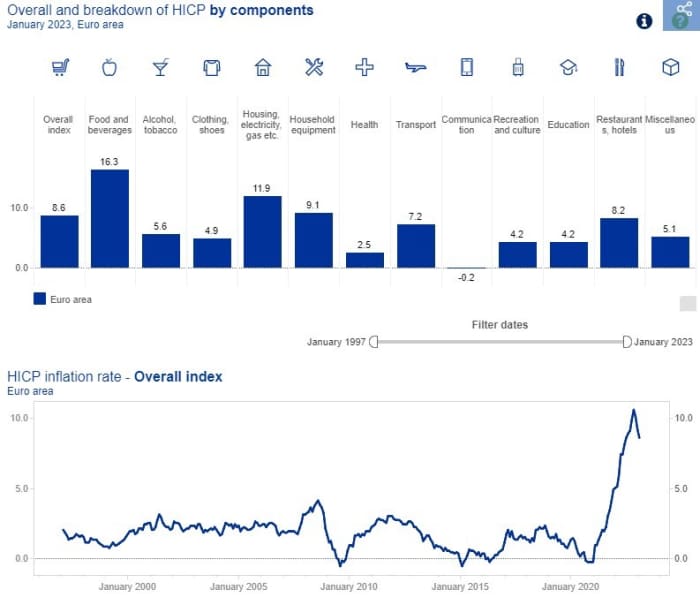

Annual consumer price inflation is expected by economists to fall from 8.6% year-over-year in January to 8.2% in February. Inflation hit a eurozone record of 10.6% in October amid surging energy prices.

Source: ECB

That pullback in inflation over recent months is based mainly on tumbling natural gas prices, helped by Europe’s decision to wean itself of Russian energy, and a relatively mild winter.

But there’s the chance of disappointment for those hoping to see declines, according to Nomura. “We expect the headline rate will be unchanged at 8.6%, but see core rising to 5.6%, which would be the highest since 1993,” said analysts at the Japanese bank in a note published at the start of the week.

And it would be wrong to place too much hope on recent falls in producer prices delivering similar declines in consumer prices, says Michael Hewson, chief market analyst at CMC Markets.

“These sharp falls aren’t being reflected in core prices, and wages are still rising. When the January CPI data was released, core CPI was at a record high of 5.2%. It has since been revised up to 5.3%. This is likely to be a big concern for the European Central Bank, and any lack of progress here is likely to be the driving force going forward, rather than continued weakness in headline inflation,” says Hewson.

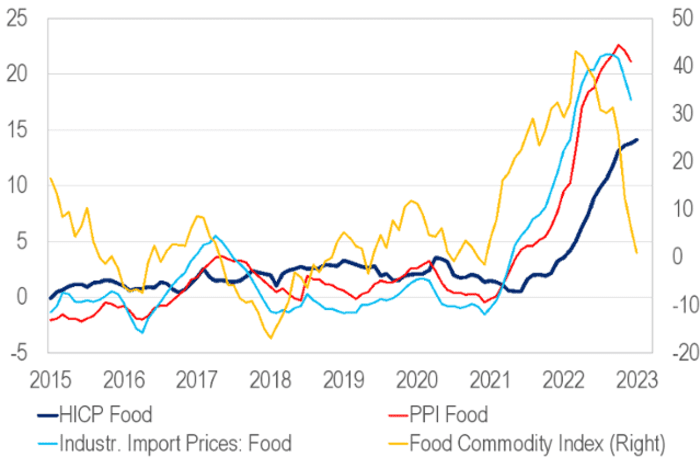

One reason for a sticky headline rate are accelerating food prices. The U.K. is not in the eurozone but the inflationary pressures impacting the wider region were illustrated by news on Tuesday that British grocery prices rose in the year to February by a record 17.1%.

Euro area food prices: % year-on-year. Source: Citi

Traders can’t say they were not warned. Data released on Tuesday showed French inflation calculated using the European Union’s harmonized standards, surprisingly rose to 7.2% year-over-year in February from 7% in January.

The same day Spain said its consumer prices climbed 5.8% year-over-year in January, after a 5.5% advance in December. German CPI data is due for release on Wednesday at 2 p.m. CET.

Furthermore, it appears likely that companies’ behavior will ensure inflationary pressures stick around. The Eurozone economic sentiment index released at the start of the week showed businesses’ price expectations over the next 12 months “remained elevated in a historical perspective,” according to strategists at Citi.

All told it suggests ECB President Christine Lagarde was right to take a hawkish stance, insisting of late that the central bank would not trim the size of rate hikes for the time being. The next ECB rate-setting meeting is March 16, and Lagarde is expected to raise the deposit rate from 2.5% to 3%. Just last July the rate was minus 50 basis points.

“Recent comments from governing council members have focused on the need for ‘robust’ signs that core inflation is slowing before downshifting . If the ECB takes a narrow approach and uses the momentum of core inflation as the sole basis for the downshift decision, then the risks would be weighted in favour of another 50bp hike in May,” says Mark Wall, chief Europe economist at Deutsche Bank.

“This would raise the deposit facility rate to 3.50%. A larger hike in May would also raise the probability of a final hike and downshift to 25bp in June15 . This means there is a real risk of a terminal rate of 3.75%!” Wall wrote in a note to clients.

However, after the French and Spanish data were released on Tuesday, probabilities derived from swaps markets showed the ECB taking the deposit rate to 4%, a record high, by February 2024. The benchmark 2-year German bond yield

TMBMKDE-02Y,

which is particularly sensitive to monetary policy, climbed to its highest level since 2008.

The good news for equity investors is that the fears of sticky inflation, alongside the upsurge in implied borrowing costs, are yet to derail the European stock market. The Europe-wide Stoxx 600

SXXP,

is up 7.5% already in 2023, with investors happy to see the sharp decline in energy costs and the revival of the Chinese economy after COVID restrictions were lifted.

Indeed, the prospect of higher interest rates is considered good news for bank earnings. The Eurostoxx banks index

SX7E,

is up 22% so far in 2023 and sits at its highest level since May 2018.

Meanwhile, the euro

EURUSD,

is down about 1.5% for the year versus the U.S. dollar. For now the prospects of higher interest rates are doing little to support the single currency. That’s because the buck is also benefiting from stubborn inflation and a relatively hawkish Federal Reserve.